Discover Off-Market Property Opportunities

Many of the best property investment opportunities never appear on public portals like Rightmove or Zoopla. Instead, these are known as off-market property deals—transactions that take place without public advertising.

At Nesthub Properties, we actively source these exclusive, high-yield opportunities for cash-rich, time-poor investors. Because of our trusted network across the UK property industry, our clients gain access to deals the general public never sees.

What Are Off-Market Property Deals?

An off-market deal occurs when a property is sold without being listed on the open market. In most cases, these sales happen discreetly through sourcing agents, investor networks, solicitors, developers, or direct vendor relationships.

Many investors prefer off-market properties because they offer more exclusivity, quicker transactions, and better pricing compared to their on-

market counterparts.

Why Off-Market Property Deals Are a Smart Investment

1. Less Competition

Since fewer buyers are involved, you can avoid the bidding wars that often drive up prices on open-market listings. As a result, you’re more likely to secure favourable terms.

2. Faster Completions

Off-market sellers are usually motivated and ready to act quickly. Because there’s no need for public listings or long viewing chains, transactions often move much faster.

3. Below-Market Value Opportunities

Sellers who prioritize speed o

r privacy tend to accept competitive cash offers. Consequently, investors can often purchase properties at 10–15% below market value.

4. Better ROI

With lower entry costs and reduced delays, investors are better positioned to achieve higher yields and long-term returns.

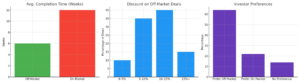

Data Insight: Off-Market vs On-Market Deals

To illustrate the advantages of off-market investing, consider the following:

-

Average Completion Time: Off-market deals typically complete in half the time of on-market transactions.

-

Average Discount Secured: Many off-market investors report buying at 10–15% below market value.

-

Investor Preferences:

-

According to a recent sur

-

vey, 64% of investors favour off-market property deals over public listings.

How Nesthub Properties Delivers Off-Market Deals

At Nesthub, we leverage our extensive property industry network to secure exclusive off-market deals tailored specifically for serious investors. Our partners include:

-

Estate agents with early access to stock

-

Developers seeking fast, discreet sales

-

Landlords divesting portfolios

-

Solicitors handling probate or distressed sales

We meticulously select each deal based on location, condition, potential yield, and investor profile. As a result, we ensure you only see relevant, profitable opportunities.

Join our investor mailing list for early access!

Who Should Consider Off-Market Deals?

Off-market property deals are especially well-suited for:

-

Cash-rich investors looking for value and speed

-

Time-poor professionals who want deals sourced and vetted for them

-

Portfolio builders aiming to scale efficiently without overpaying

-

High-net-worth individuals seeking exclusive, off-radar assets

Final Thoughts

Off-market property deals are not only real—they’re powerful. They offer more control, better pricing, and faster outcomes. With Nesthub Properties, you no longer have to compete on the open market or waste time chasing dead-end leads. Instead, we bring you genuine off-market investment opportunities that align with your goals. Moreover, we do it with integrity, speed, and precision.